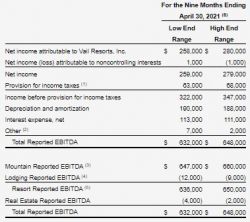

Vail Resorts Provides Updated Outlook for the Nine Month Period Ending April 30, 2021Vail Resorts, Inc. updated its guidance range for the nine month period ending April 30, 2021. The Company now expects net income attributable to Vail Resorts, Inc. to be between $258 million and $280 million and Resort Reported EBITDA to be between $636 million and $650 million. Commenting on the outlook for the nine months ending April 30, 2021, Rob Katz, Chief Executive Officer said, "We are increasing our guidance primarily as a result of stronger than expected performance in March and April. Despite the challenging operating environment as a result of COVID-19 related limitations, our results continued to improve as the season progressed, primarily driven by the performance of our Colorado and Utah resorts where visitation, including lift ticket purchases, exceeded expectations. Destination visitation at our Colorado and Utah resorts proved more resilient than anticipated while local visitation remained largely in line with expectations. Our ancillary lines of business continued to be negatively impacted by COVID-19 related limitations and restrictions but revenue still outperformed expectations in March and April due to the improved visitation trends in Colorado and Utah. Whistler Blackcomb's performance continued to be negatively impacted due to the Canadian border remaining closed to international guests and was further impacted by the resort closing earlier than expected on March 30, 2021 following a provincial health order issued by the government of British Columbia. We have continued to maintain disciplined cost controls as we near the end of the 2020/2021 North American ski season." Commenting on early season pass results, Katz said, "We are very pleased with the response to our season pass sales launch. The pace of sales has been strong over the first month of the selling period, and we are seeing great guest enthusiasm for the enhanced value proposition of our products. We will be providing additional detail on our spring pass sales in our third quarter earnings release in June 2021." The following table reflects the forecasted guidance range for the Company's nine months ending April 30, 2021, for Reported EBITDA (after stock-based compensation expense) and reconciles such Reported EBITDA guidance to net income attributable to Vail Resorts, Inc.

|

ropeways.net | Home | Economy | 2021-04-29

More articles:

Mountain Travel Symposium Summit Award

2024-04-22

Snowsports Merchandising Corporation and Sports Specialists Ltd. Announce Official Merger

2024-04-19

Google Adsense

Back

Back Add Photos

Add Photos Print

Print